Why Adam Smith Does Not Work!

Another Force Present: Cantillon Effect

Though Adam Smith gets the lion’s share of the credit for defining modern economics, he takes a back seat to Richard Cantillon who laid the framework which made Adam Smith’s theory possible {Richard Cantillon: The Founding Father of Modern Economics. Mises Daily Articles. Mises Institute.}. His only surviving treatise, Essai sur la nature du commerce en général, {Essay on the Nature of Trade in General} predated Adam Smith’s, Wealth of Nations, by forty years. One of his most intriguing concepts has come to be known as the Cantillon Effect which is the subject of this short post. Not only is it unknown to most non-economists, it is obscure even to most economists; Austrian, Keynesian, Chicago School or otherwise! But first, we must obey Logic’s Law of Identity and define some banking terms and operations; it will not be long or boring but it will be surprising!

Today’s Monetary Systems are Debt-Based!

Monetary Units Measured by Purchasing Ability

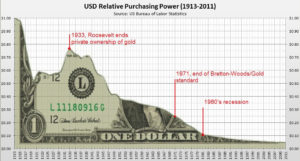

I would encourage every reader to watch this short YouTube video, How do Banks actually create money?, to grasp a couple of very fundamental banking concepts. First, there are two different banking systems at work in nearly every country. There is the Central Bank, a private non-governmental agency tasked with money creation. This bank and any affiliates usually do not interact with the public or businesses. It seeks to Control the monetary supply and the purchasing ability of each unit of whatever instrument it uses; in America it is the dollar, in Great Britain the Pound and so forth. The second system of banks are commercial and public banks which operate separately but are totally dependent upon the Central Banking system for monetary supply, Control and guidance. The various national Central Banks network through, and probably controlled by, the Bank for International Settlements (BIS). The BIS coordinates these Central Banks according to its own secretive agenda; more on that later. As you can see from the above graphic, the dollars purchasing ability, I prefer to use this term rather than purchasing power as it has no innate energy, has declined every since America created the Federal Reserve, our Central Bank.

Every since the development of private Central Banks which began with Great Britain, a nation’s monetary supply and thus its fiscal health has been Controlled by these private entities with little to no real oversight by their respective governments. Each nation’s money supply is not tied to wealth creation or commodities such as gold; instead, the monetary supply is created by taking on debt! If all debts, public and private, were paid off and/or liquidated, there would be no monetary supply; or so I am told! Your dollars would have no purchasing power and thus would be worthless; almost as they are now!

Finally, banks do not hold or take on deposits! You give your money to your bank or financial institution which records it on their books as a debt, their debt. It is a debt because it is immediately used to purchase securities. You use the term loans but in the banking industry these are called securities. When you asked the bank for a home loan, you house secured the funds the bank used to purchase the house. It is the real owner and you are the caretaker responsible for taxes, maintenance, upkeep and any losses to the security. This is what the bank records on its balance sheet: debts (negatives) {deposits to you} on one side and securities (positives) {loans to you} on the other side of the ledger. The bank is complicit in your deceptive thinking of deposits and loans. Politicians and media news-propaganda purveyors are also duped making it impossible for them to Control or even know what the banking industry is doing! This is why analysis and so-called solutions according to Adam Smith’s free market myth fail; there is no free market. There never has been one!

Richard Cantillon Saw France’s Currency Fail;

He Made Millions Understanding Central Banking

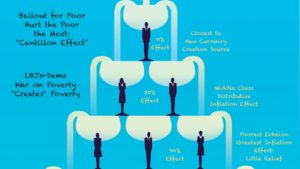

We will look at only one aspect of what today is called, Cantillon Effect. At its most fundamental this postulate shows that those closest to monetary creation gain the greatest profit and suffer the least from its negative effects; more specifically for our discussion, its inflationary effects. Why does a debt-based monetary system work? Adam Smith taught that money linked to wealth creation balances purchasing ability of available instruments. If too many dollars are produced then each dollar is worth less if wealth remains fixed; we call this inflation. However, this is neither a static nor an instantaneous change in the monetary system. For example: imagine a water tank with a tuning fork in the center. When the tuning fork is tapped oscillations are produced in the water closest to the fork and proceed outward until reaching the container’s sides then reverberate. If these oscillations are in sync then they amplify; if they are not in sync then the oscillations are damped.

In the above graphic imagine that monetary instruments are flowing into the hierarchical system. The first person, closest to the source, suffers no inflation as he uses these new dollars to purchase whatever services are available and profitable. As the flow continues into the system the purchasing ability of these dollars decreases, thus you need more dollars to purchase the same goods and services. However, those goods-services deemed more vital decrease in availability and increase in price; this is inflation. As the flow continues down the hierarchy the rate of inflation increases and the availability of vital goods decreases! Let us look at a current real world example.

The Democrats, with Republican approval, passed trillion dollar bailout relief legislation ostensibly to benefit the poor! This was propaganda to gain YOUR approval. According to the Cantillon Effect, The Federal Reserve members and its associated banks, including investment-type or so-called Wall Street Banks, benefited greatly because their new dollars had not yet decreased in value; i.e., inflated. The Middle Class access to these funds was limited by their income but they would lose since they will pay higher taxes to fund these new dollars not linked to wealth creation; i.e., no increase in wealth to maintain purchasing ability. But the poor who were the excuse for this largess increase in wealth at the upper echelons will suffer the most. The few dollars they receive will have greatly decreased purchasing ability and the effects of inflation will already have driven up prices on those goods-services they desperately need. They become the knowing victims which politicians use to excuse another round of COVID-19 Relief bailout funds; mainly for themselves. This is why the Democratic Great Society and War on Poverty never reduced poverty; it could not as it was practiced. Anyone who understood the Cantillon Effect understood this; but, not the average voter who was manipulated into voting for his own increased taxation with representation.

Cantillon Effect Also Works on Nations;

BIS Keeps Poor Nations Poor for Wealthy Nations

The BIS, in coordination with the United Nations, uses the World Bank (WB) and the International Monetary Fund (IMF) against impoverished and developing nations in the same manner. Their loans, ostensibly to help these nations, stipulate, usually, that favored multinational corporations can come into the country to develop its resources without being taxed or regulated! Thus, these poor nations are being systematically stripped of resources that should benefit them and increase their currency’s purchasing ability. They gain almost no benefit while supplying the raw materials for the wealthy nations’ green programs; which in itself is another Cantillon Effect scheme though non-fiscal! This is how Great Britain grew its empire and America learned it well. Since the original Bretton Wood Accords (1944), America has been the economic powerhouse due to its close ties with the BIS coupled with its then industrial and military might (which it was not afraid to use to defeat Communism, of course)!

Though the Quote is Disputed,

It Remains the Truth in Practice

The City of London is not a part of Great Britain! The central district houses the Bank of England (Central Bank) and its cluster of primary investment banks and financial institutions free from Britain’s laws. England’s monarch must ask permission even to visit. This bank was the first modern Central Bank and was instrumental in the formation of the BIS. Its close, intimate ties with the Federal Reserve system explains why America has not yet financially failed despite its drunken orgy debt spending that should have cripple the government under Adam Smith’s theory. The international financial system operates behind the scenes unhampered by governments who desperately need the inflow of continual debt-base currency units to remain in power. The powerful politicians are powerful because they follow their instructions which they receive annually at the G-numbered conferences. The World Economic Forum (WEF) is the front organization for the BIS and trains selected citizens from business, education, finance and politics in the approved doctrines to advance the globalization agenda. Their goal: You will own nothing and be happy…or you will be unable to buy or sell under the coming digital currency tyranny that is the Great Reset!

Christ told His apostles that they will always have the poor with them (Jn 12:1-8). This was not a denigration of the poor, it was a condemnation of Judas, a thief who objected to Mary anointing Jesus with expensive perfume. Not because he cared about the poor, but because if he could have sold the perfume he could have appropriated some of that for his own profit. He was a thief which is why he betrayed Christ for a paltry sum. He had no vision. Today’s politicians have great visions of personal wealth. They use the poor callously for their own gain even as they work to enslave their nation and government to those unaccountable people behind the scenes: The Financiers were made powerful because of unbiblical doctrines that prevented governments from borrowing from Christians with usury or interest. Instead, it came from other sources that remained outside government and became the pattern for Central Banks. Yes, bad Bible hermeneutics can have disastrous and long-term consequences. Hence, study to show yourself approved and learn to discern good from evil (2Ti 2:15-16; He 5:11-14). This coming evil is of man’s own making under Satan’s behind the scenes guidance because both wanted a world without Christ (Ro 1:18-28). It will not be pleasant as there will be little mercy, compassion or forgiveness no matter how often they use those words.